Welcome to Atlantic Stewardship Bank

Mobile Banking

With your busy lifestyle, you need a better way to manage your finances. The ASB Mobile Banking solution is right at your fingertips and it’s FREE*. Mobile Banking provides convenient options to manage your finances from wherever life takes you. Whether you choose to use our mobile apps, mobile web banking or text banking, you’ll keep on top of your finances with just the touch of a button.

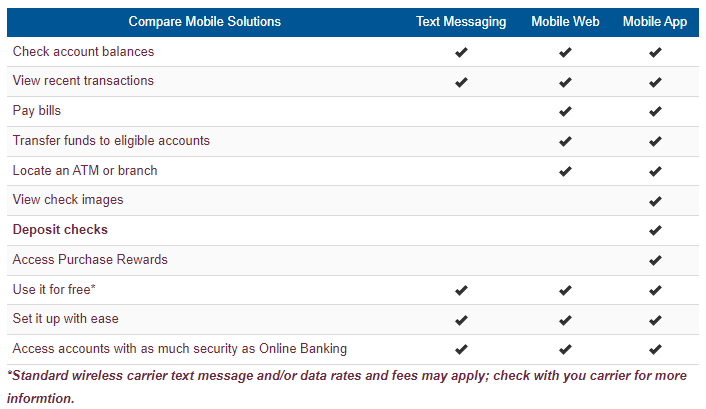

See the chart below to determine which one is right for you.

Mobile Apps – Smart Phones and iPad

Why mobile apps?

Use your iPhone, iPad or Android device to access your ASB account with the touch of a button.

- Deposit checks with your iPhone or Android Smartphone

- Transfer funds between your own ASB accounts

- View account balances and transaction history

- Pay bills

- View check images

- View Purchase Rewards on iPhone and Android

- Locate branches and ATMs

- Contact us

- Use your existing ASB Online Banking log-in

How do I get my mobile app?

Simply go to the app store on your device and search for Atlantic Stewardship Bank. Or, scan the appropriate QR Code to the right with your smart phone.

How do I deposit checks?

Once you’ve downloaded the ASB App, select “Deposit Checks”. Register for Mobile Deposit; once your registration is approved you may begin using Mobile Deposit. With your Smartphone, take a picture of both sides of your endorsed check. The check must be endorsed with For Mobile Deposit Only and the payee’s signature. It’s that simple, just hit deposit and you’re done!

Mobile App Security Best Practices

Best Practices for Security are:

- Use a PIN for access to your phone or IPAD, you need to set this up

- Set up an automatic lock for the keyboard after a predefined time so that the user will need to enter a PIN to unlock the keyboard.

- Never store confidential information (PIN, User Name) on your device

- Never divulge your PIN to anyone

- Change your PIN regularly

- Protect your phone with an app such as:

- Find phone

- Call your provider to see if they can wipe your phone if its lost

- Never save your user name on your phone

Mobile Web Banking

Why mobile web?

With Mobile Web Banking you can:

- Transfer funds between your own ASB accounts

- View account balances and transaction history

- Pay bills

- Locate branches and ATMs

- Contact us

- Use your existing ASB Online Banking log-in

Mobile Banking Security Best Practices:

- Use a PIN (Personal Identification Number) to manage access to your phone. When you switch on your phone the PIN should be required.

- Set up an automatic lock for your phone keyboard, so that after a predefined time, you will need to enter your PIN to unlock the keyboard.

- Never store confidential information (such as your PIN) on your phone, and never divulge your PIN to anyone.

- Change your PIN regularly.

Text Banking

Why text banking?

Enables you to securely check balances and transactions anytime, anywhere via a simple SMS text message.

- View account balances and transaction history

- Transfer funds between your own ASB accounts

- Get automatic alerts such as weekly balance texts and low balance alerts

- Add a second phone to the account

Home | About | e-Services | Personal | Rates

Copyright © Asbnow.com 2025